The Pacvue Q1 2025 Retail Media Report just dropped a few weeks ago, and we thought we would take a look at it to identify some interesting trends and takeaways for your business. We’ll recap the facts, analyze the trends, and tell you what we think this all means.

TABLE OF CONTENTS

1. US Brands are Investing More into Upper Funnel Amazon Strategies2. EU Brands Seeing Incremental Growth in Amazon PPC

3. Walmart Brands Prioritizing Lower Funnel, Return-Focused Strategies

4. Key eCommerce Trends Driving Consumer and Advertiser Behavior

US Brands are Investing More into Upper Funnel Amazon Strategies

With competition ever growing in size as brands flock to Amazon, companies are under increasing pressure to keep up with their paid marketing efforts. Two things come into mind with this investment: having a bigger marketing budget is a good thing because paid marketing gives organic performance a boost, but spending more money in the wrong places will earn your diminishing returns. As such, knowing where to invest is key.

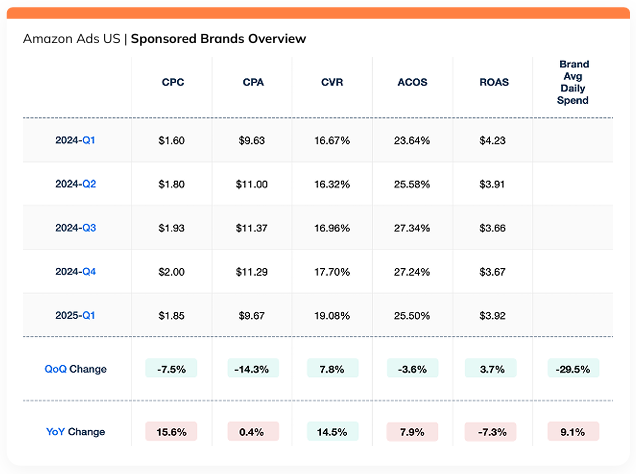

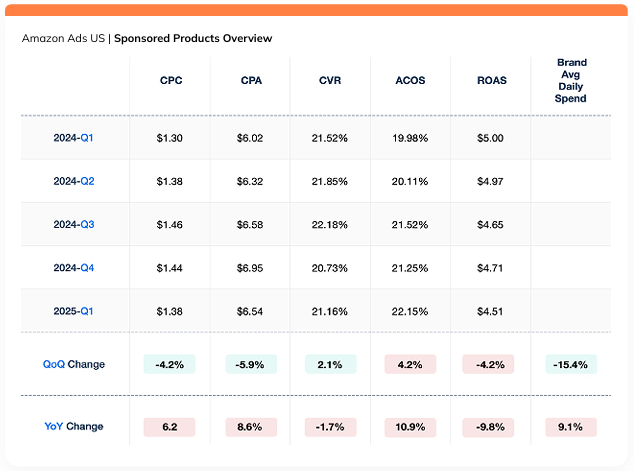

For the first quarter of 2025, US brands on average spend 9% more on PPC advertising compared to last year, driving up CPC in both Sponsored Brands and Sponsored Products solutions. However, Sponsored Brands saw a 14.5% improvement in CVR, whereas Sponsored Products’ CVR remained mostly stable.

Aside from Sponsored Brands, sellers are also enrolling in Amazon DSP to engage with customers outside of the Amazon platform. US brands saw a 25.4% increase in daily ad spend on DSP, a significant feat considering the high cost of entry for this ad vehicle. We have not reached the point of diminishing returns for this vehicle: even with such a dramatic increase in spend, DSP still drove 36.5% new-to-brand sales, which is a small 2.3% dip from Q1 2024. With that being said, this solution is continuing to drive brand awareness, turning fence sitters into active shoppers.

KEY TAKEAWAY: There is a clear trend of brands investing more into upper funnel marketing strategies. Consider capitalizing on this growth if your brand is already recognized in the marketplace and your products can benefit from the strong imagery and storytelling of Sponsored Brands and DSP ads.

EU Brands Seeing Incremental Growth in Amazon PPC

The Amazon PPC market in Europe is showing incremental growth in all facets of performance. Nonetheless, EU brands are still cautious with their ad dollars as they slowly familiarize themselves (and their consumers) to online shopping habits. While CPC benchmarks for both Sponsored Brands and Sponsored Products are much lower than that of the US, we are still seeing the cost-conscious mindset of EU brands in action here: they prioritized lower funnel strategies and invested more dollars into the ad vehicle that gives them the best short-term payoff.

KEY TAKEAWAY: If your brand has an EU presence (and a little more money to spend on advertising), jump ahead of the competition to establish brand awareness through Sponsored Brands ads. This way, customers become familiar with your brand now versus later, when everyone else is also gunning for brand awareness and driving up costs.

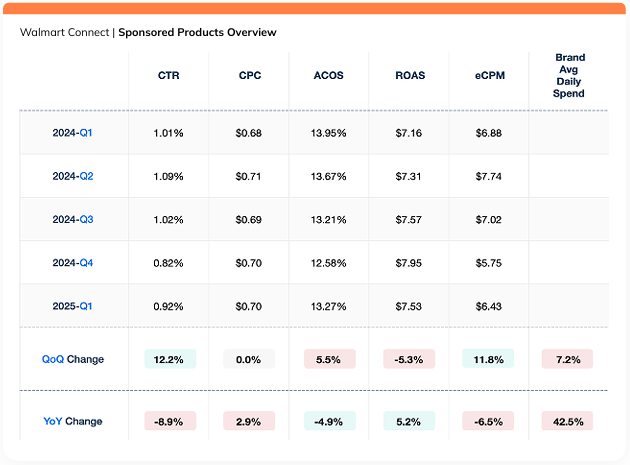

Walmart Brands Prioritizing Lower Funnel, Return-Focused Strategies

Even though both Sponsored Brands and Sponsored Products saw an increase in average daily ad spend (32.8% and 42.5% respectively), performance dipped heavily for Sponsored Brands ads. On the other hand, Sponsored Products continued to deliver reliable results, with Return on Ad Spend increasing 5.2% from Q1 2024.

As Walmart advertisers pull away from Sponsored Brands to reinvest into Sponsored Products strategies over the last quarter, we are still seeing an overall drop in ad performance, reflected by the lower CTR in both ad types compared to last year. We suspect this behavior is due to many reasons, including tariff concerns, rising living costs, and ongoing boycotts against Walmart as a retailer.

KEY TAKEAWAY: Shoppers exhibit different behavior when on different platforms. Walmart consumers are more likely to be cost-conscious, leading to diminishing returns on brand awareness tactics. Sticking close to the bottom of the funnel might be a better move right now.

Key eCommerce Trends Driving Consumer and Advertiser Behavior

The biggest driver of Q1 2025 trends included astronomical tariff rates hitting Chinese imported goods. In these unprecedented times, companies are forced to reassess these supply chain operations as well as marketing strategy to best position themselves to the consumers. As goods climb in price, shoppers tighten their budget and become more deliberate in their purchase. In other words, now more than ever, your brand and products have to provide additional value to justify your prices.

A general kneejerk reaction to softening customer intent is to pull back on marketing spend. However, we are seeing the opposite of this play out, especially in the US market where competition is strong, and pulling back means losing impression share. According to Melissa Burdick, Pacvue’s President and Co-Founder, this is because “rather than slowing down, many sellers are using this moment to realign with what matters most: operational efficiency, smarter investments, and deeper customer relationships.” This is clearly reflected in the rise of Sponsored Brands and DSP spending: brands are placing additional emphasis on growing brand awareness and building trust with their customers. This way, new-to-brand customers will transform into loyal customers and hopefully bring even more shoppers into the fold.

Crafting a Marketing Strategy that Works for You

Brands that are established enough to weather the storm will find this to be the perfect opportunity for building brand awareness through upper funnel strategies. Focus on refining your brand identity and narrative, because these two things will help you promote your products in ways that feel authentic and relatable to shoppers.

However, if you’re a smaller guy in this competitive market, holding on to a big marketing budget while the economy slows down might not be possible. This is where the “smarter investments” piece of Burdick’s advice comes into play. If you must shrink your budget, do not reduce it to zero: you’ll kill your ads’ momentum. Instead, retain a core amount that can sustain a basic advertising structure and experiment with your tactics until you find something that works the best. From there, divest from other strategies and focus your resources on what’s moving the needle for your business.

VASO Group is Your Partner in Advertising

Don’t be bogged down by bloated marketing teams. At VASO, our advertising team has a mantra: we are lean and mean. Our smaller size allows us to be much more flexible when dealing with clients, and the runtime from decision to execution can be as short as a few minutes. We also aim to embed closely into your business so we can understand your operations inside out, which gives invaluable context that drives our optimization decisions. We are committed to being your partner in advertising, and we can help you with any marketing needs. If you find the information here helpful, and want extra help assessing your own strategy, reach out for a consultation today.

Want an impactful marketing strategy that grows your bottom line?